You may look into a personal loan for purposes such as consolidating debt, paying off medical bills or covering home repairs. Personal loans are typically unsecured, meaning they don’t require collateral, but lenders require some personal loans to be backed by something that holds monetary value. Collateral on a secured personal loan can include things like cash in a savings account, a car or even a home.

Read along to learn more about what collateral is, what can and cannot be used as collateral for a secured personal loan, and what the advantages and disadvantages of secured personal loans are.

What Is Collateral?

Collateral is simply an asset, such as a car or home, that a borrower offers up as a way to qualify for a particular loan. Collateral can make a lender more comfortable extending the loan since it protects their financial stake if the borrower ultimately fails to repay the loan in full.

If the borrower defaults on the loan, the lender can seize the collateral to help compensate for its financial loss. So, if you put up your car as collateral for a personal loan but wind up being unable to repay the loan, the lender could take ownership of your car.

Because they’re backed by collateral, secured loans typically offer lower annual percentage rates (APRs) and shorter payoff periods. But, of course, if a borrower can’t keep up with payments on a secured loan, they could lose their collateral.

When you take out a secured personal loan, the lender often puts a lien against the collateral. The lien gives a lender the right to take your property if you fail to pay back the loan. But you can still use your collateral, such as a car or home, while you’re paying off the loan. Once you’ve paid off the loan, the lender removes the lien on your property.

In addition to causing you to lose whatever asset is securing a loan, defaulting on a secured loan can have severe credit consequences. A defaulted loan will remain on your credit report for seven years and affect your credit score the entire time it’s there. As time goes on, however, this impact will be lessened, and the score impact of a defaulted loan may be smaller if your scores are already low.

By contrast, an unsecured loan doesn’t require collateral. Lenders who issue unsecured loans seek reassurance that the loan will be repaid by looking at your creditworthiness as determined by your credit scores and the information in your credit reports, as well as your income and other factors. Unsecured loans have the same credit consequences as secured loans, but defaulting on them won’t directly result in the loss of property.

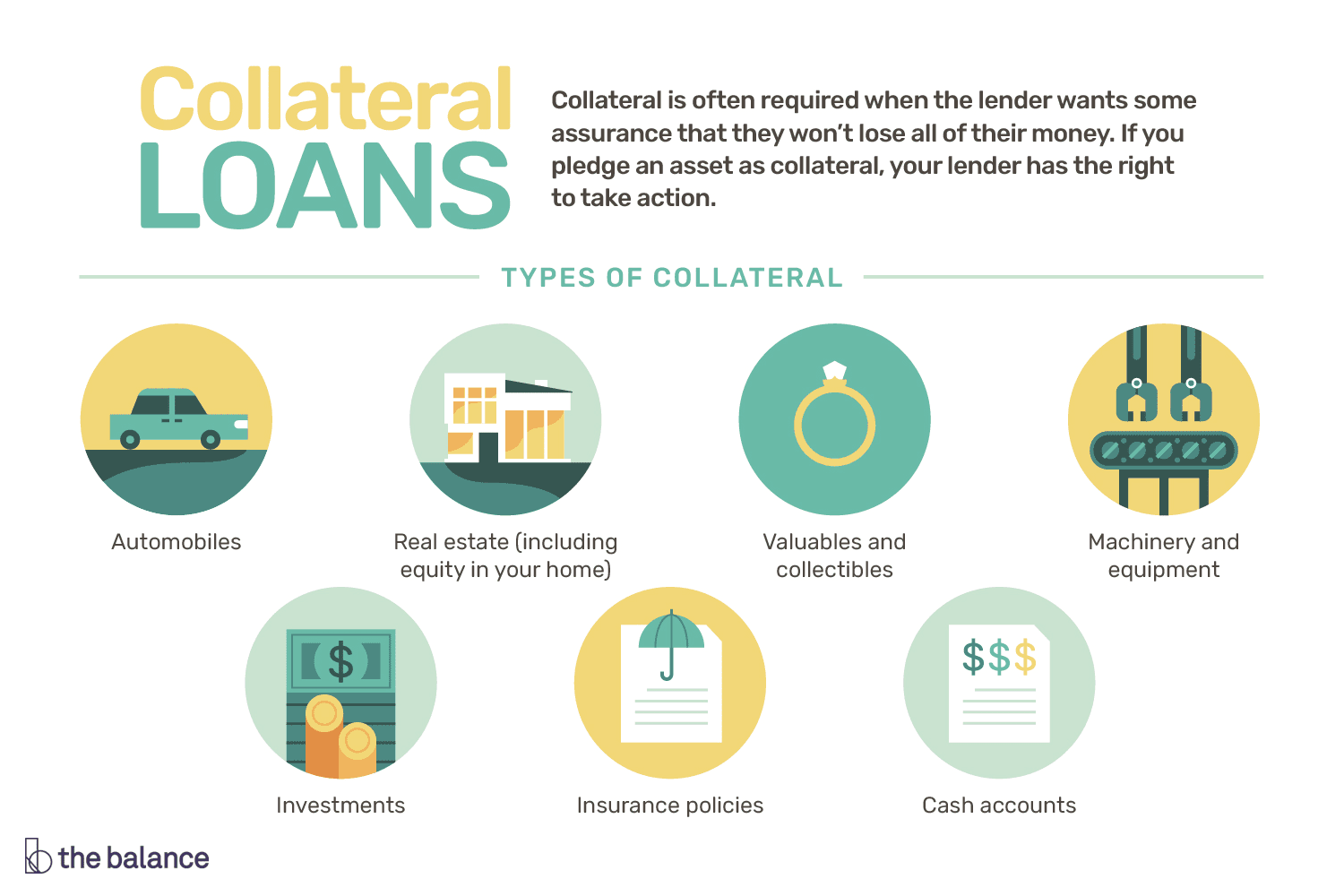

Types of Collateral You Can Use

Several types of collateral can be used for a secured personal loan. Your options may include:

- Cash in a savings account

- Cash in a certificate of deposit (CD) account

- Car

- Boat

- Home

- Stocks

- Bonds

- Insurance policy

- Jewelry

- Fine art

- Antiques

- Collectibles

- Precious metals

- Future paychecks

Pros and Cons of Collateral on a Loan

Putting up collateral for a secured personal loan may be the only way you’re able to borrow, but keep in mind that doing so comes with both pros and cons.

Pros include:

- Putting up collateral may make it easier to obtain a loan than if you don’t put up collateral, particularly if you have a damaged credit history or no credit history at all.

- Because your collateral reduces the financial risk for a lender, you may be able to borrow more money than you’d be able to with an unsecured loan.

- Secured loans typically offer lower interest rates and longer repayment periods than unsecured loans.

- A secured loan may help boost your credit. Making on-time payments toward a secured loan can help you establish a credit history if you don’t have one or help improve your credit if it’s been damaged. If this is a priority for you, make sure your lender reports your payments to the major credit bureaus.

Cons of a secured personal loan backed by collateral include:

- Your collateral could be taken by the lender if you default on the loan.

- Aside from seizing your collateral, a lender may tap a debt collector to seek overdue money from you, may report your missed payments to credit bureaus or may even take you to court in an attempt to collect what’s owed.

- If you use a savings account or CD as collateral, a minimum balance may be required.

- The lender may restrict how you use the money you borrow.

- Some lenders may charge high interest rates or high fees for secured personal loans, especially if you have bad credit.

What to Know Before You Sign a Loan Agreement

Before you sign on the dotted line for a secured personal loan, be sure you’re aware of:

- How much money you’re borrowing.

- What the APR is.

- What penalties there are for late payments or an early payoff.

- How much the monthly payments will be.

- What happens to your collateral if you can’t repay the loan.

The Bottom Line

A loan that requires collateral may be the only type of loan a lender will offer you, especially if your credit scores are low. Before you submit any loan applications, however, be sure to get your free credit report from any of the three credit bureaus in Kenya: TransUnion, Metropol or CreditInfo.