When you apply for a loan, your lender looks at your financial profile to find out what type of borrower you’re likely to be. Your credit score assesses the likelihood you’ll miss a payment in the near future. Your credit report shows how responsibly you’ve handled debt and expenses over time. And your debt-to-income ratio (DTI) gives lenders a quick indicator of how much debt you can currently afford.

If you have a lot of debt, you may need to reduce your DTI to convince lenders you have the ability to take on another financial obligation. To reduce your DTI, you’ll need to understand what goes into calculating it and what actions you can take to put yourself in a better borrowing position.

Before you start submitting credit and loan applications, take a moment to calculate your DTI. What you learn may help you find the best loans and credit, help you decide which borrowing options are right for you, and help you take measures to improve your odds of approval.

What Is Debt-to-Income (DTI) Ratio?

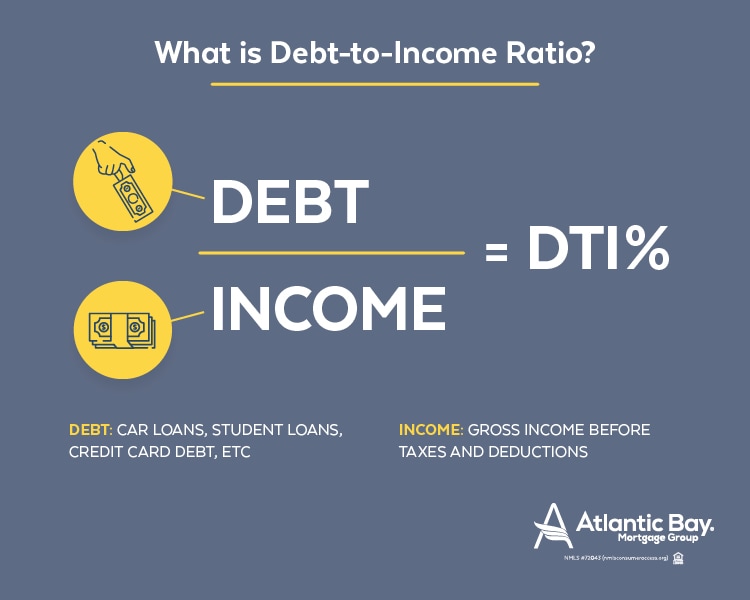

Your DTI ratio shows how much debt you pay each month compared to your monthly income. Lenders use DTI to determine how much additional debt you can afford when you are applying for a loan. Together with your credit score and report, DTI helps to paint a picture of your overall financial health and your ability to repay a loan.

DTI can come into play when you’re applying for almost any type of new credit: mortgages, home equity loans, auto and personal loans, and even new credit cards. A high DTI may signal to a lender that your debt load is unmanageable—or could become so with the addition of new credit. That makes you a greater credit risk and may hamstring your ability to get a new loan or credit approved.

How Do You Calculate DTI?

If you’re about to apply for a new loan, calculating your DTI can help you understand how a lender will view your application. It’s not difficult to make this calculation, but you will need to gather some information.

There are two types of DTI lenders might consider when you’re applying for a loan:

- Front-end DTI includes your regular monthly housing expenses: mortgage or rent, home or renters insurance and property taxes. It does not include utilities, phone bills or similar expenses.

- Back-end DTI includes all of the monthly housing expenses listed above as well as any additional monthly debt payments: credit card minimum payments, student loans, personal loans and auto loans.

To calculate your DTI, first determine what your gross monthly income is. That’s what you earn monthly before taxes and other payroll deductions, plus any tips, bonuses, business income, pensions, social security, child support or alimony.

Divide your total monthly housing expenses by your gross monthly income to get your front-end DTI. Add your monthly housing expenses and your monthly debt payments, then divide this figure by your gross monthly income to get your back-end DTI.

Let’s say your gross monthly income is KES.7,000 with a monthly housing expense of KES.2,250 and additional monthly debt of KES.600.

Your front-end DTI:

2,250 / 7,000 = 32%

Your back-end DTI:

(2,250 + 600) / 7,000 = 2,850

2,850 / 7,000 = 41%

What Is Considered a Good DTI?

Lenders often set their own requirements on DTI, so there is no absolute standard for good or bad ratio. From a lender’s perspective, the lower your DTI, the better. Like good credit, a low DTI ratio helps you secure the best interest rates and terms on a loan. That said, mortgage lenders generally require borrowers to have a back-end DTI of 43% or less to qualify for a mortgage; many lenders prefer a DTI of 36% or less.

If you’ve been told your DTI is too high to qualify for a particular loan—and the tips below don’t help you reduce your ratio—consider shopping around. You may find a lender with unconventional loans or different DTI requirements who is willing to work with you, especially if you have good credit. Alternatively, you may need to be flexible on interest rates and fees in order to find a loan that works. If your DTI is 50% or higher, your options may be limited.

How Can You Reduce Your DTI?

You can improve your DTI by either reducing your monthly debt payments or increasing your income. Here are a few questions to help get you in the mindset:

- Can you pay off any of your debts? Are you close to paying off an auto loan, for example? Do you have the cash to pay off one or more of your credit cards? If you can dispose of any debt, you can reduce your monthly debt expenses and quickly lower your DTI.

- Are you accounting for all of your income? Include all the income you receive when filling out your loan application. Do you make money from a second job or side business? Are you collecting child support or alimony? Do you have any passive income or pensions?

- Can you negotiate a raise, work overtime or land a higher-paying job? If a raise or promotion is possible in the near future, it might be worth waiting on a loan application.

- Is it possible to reconfigure your debt? You might be able to lower your monthly credit card payments with a debt consolidation loan.

Also consider this: If DTI is preventing you from getting a loan, ask yourself whether this is a good time to take on additional debt. Using more than 43% of your income to service your debt doesn’t leave much for food, clothing, taxes or savings—to say nothing of health care, entertainment, travel or other expenses. If you can’t reduce your DTI by legitimately raising income or lowering debt, make sure the benefits of any new debt you’re contemplating are really worth it.

Does DTI Affect Your Credit?

DTI does not affect your credit report or score. That’s because income information does not appear on your credit report, so credit reporting agencies can’t calculate DTI. DTI also doesn’t reflect your credit status: You can have an excellent credit score and a clean credit report and still have a high debt-to-income ratio. In fact, many people do.